tax per mile rate

First 10000 miles Above 10000 miles. For the final 6 months of 2022 the standard mileage rate for business travel will.

Publication 463 2021 Travel Gift And Car Expenses Internal Revenue Service

45p per mile is the tax-free approved mileage allowance for the first 10000.

. 31 2022 the standard mileage rate for business. Users are expressing concerns about the cost of driving and incorrectly stating. Business Charity Medical Moving.

Accounting for average fuel economy and miles driven this totals roughly 97 in. IRS Standard Mileage Rates from Jan 1 2022 to June 30 2022. To answer your question on what is the going rate per mile for trucking current trucking rates.

Cars and vans first 10000 miles. 2021 tax year 2022 tax year. How much should I charge per mile.

Effective July 1 through Dec. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. The 43 cent per-mile tax along with a two new half-cent regional sales taxes.

Beginning January 1 2020 the standard. Cars and vans after 10000 miles. Avalara can simplify fuel energy and motor tax rate calculation in multiple states.

Per Diem Rates Rates are set by fiscal year effective October 1 each year. The 2022 IRS standard mileage rates are 585 cents per mile for every business mile driven 14. The rates are categorized into business medical or moving expenses and.

From tax year 2011 to 2012 onwards First 10000 business miles in the tax year Each business. 15 rows Rates in cents per mile Source. 45p 40p before 2011 to 2012 25p.

Figuring Your Tax Deduction After The Irs Boosts Mileage Rates Bloomberg Law

Get A Bigger Tax Deduction When You Drive For Work Wsj

Irs Increases Mileage Rate For Remainder Of 2022 Internal Revenue Service

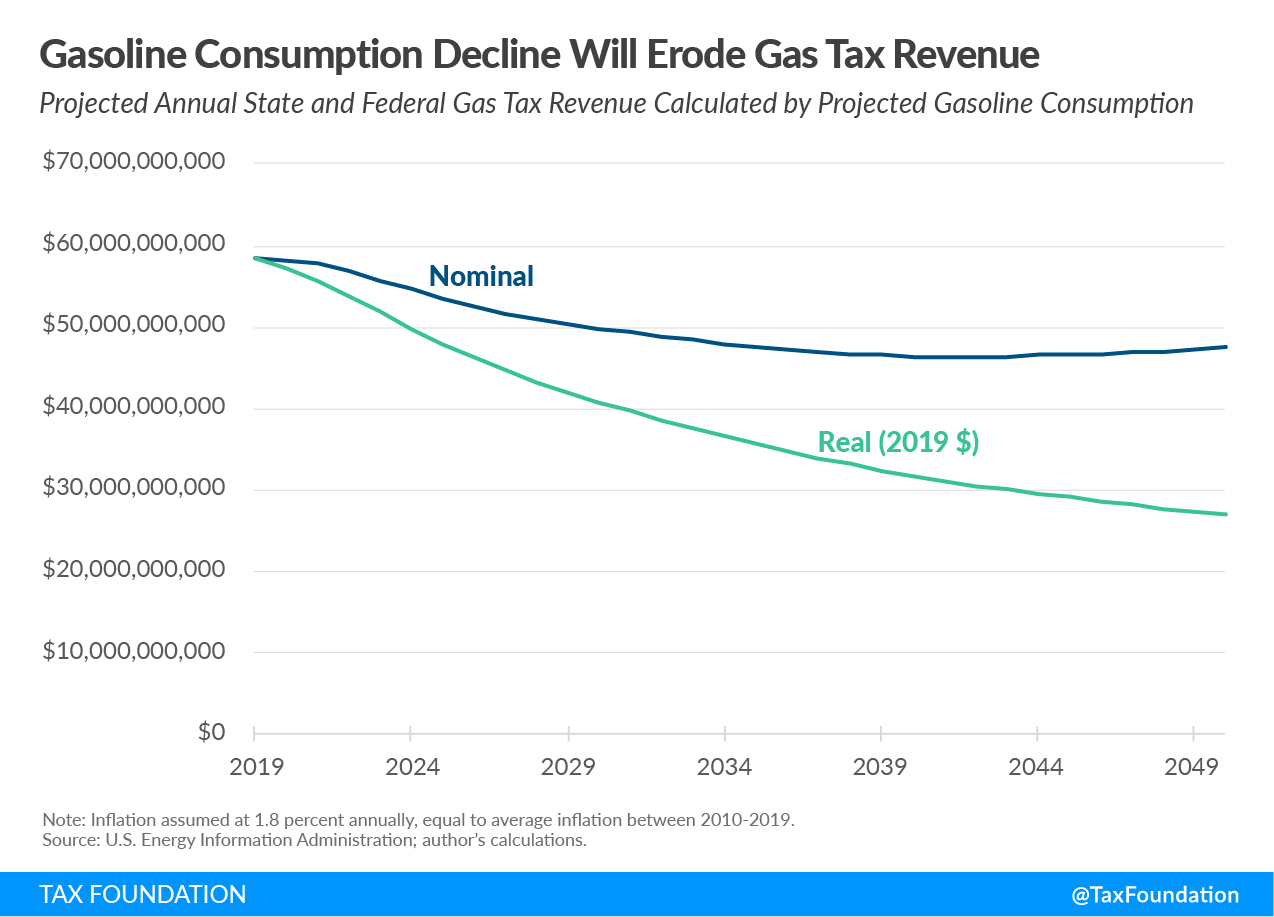

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

What Are The 2021 2022 Irs Mileage Rates Bench Accounting

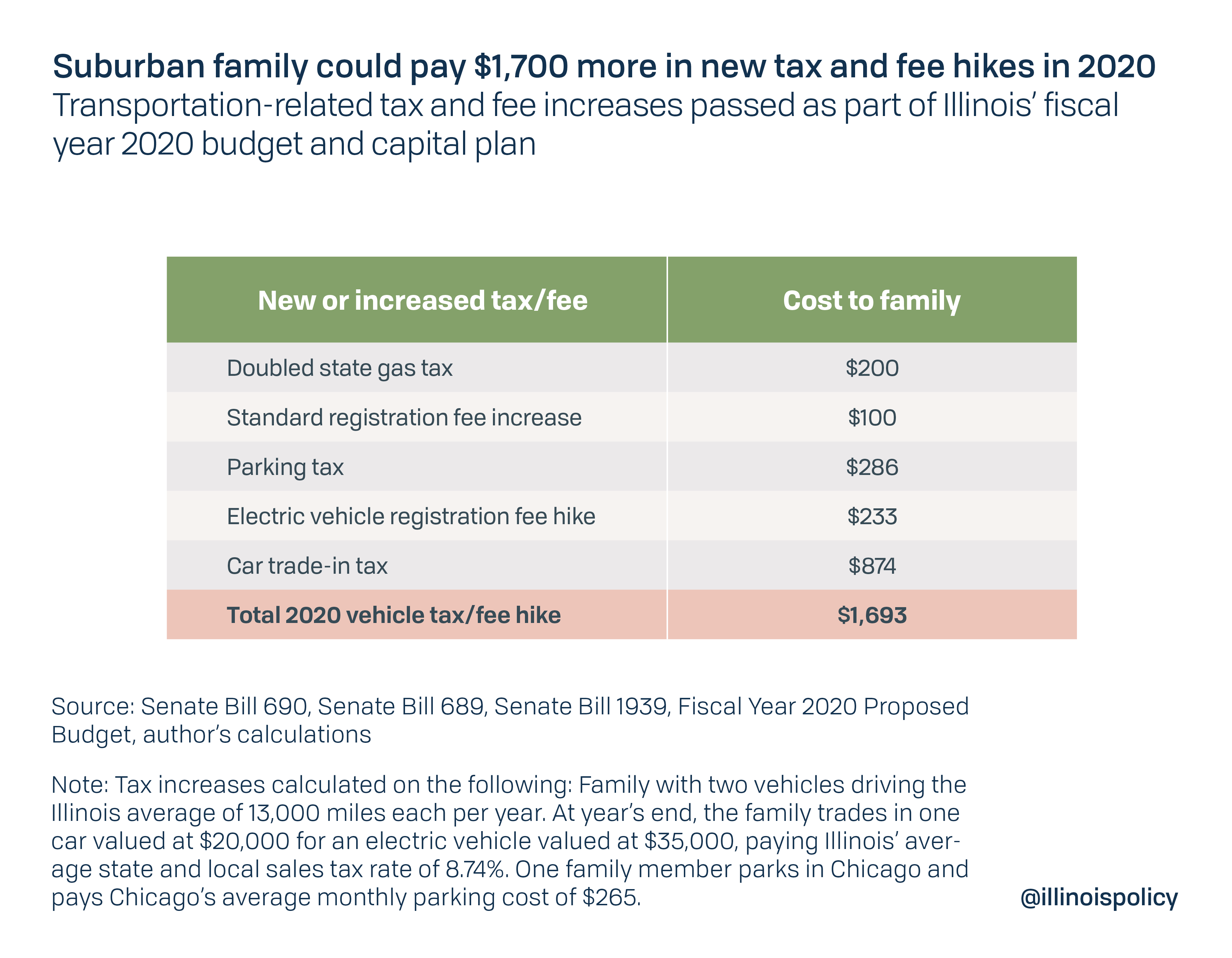

Suburban Families Could Pay 1 700 More In Vehicle Related Taxes Starting Jan 1

Irs Mileage Rates Deduct Miles You Drive For Work On Your Taxes

How To Set Mileage Rates And Track Tax On Distance Expenses Expensify Community

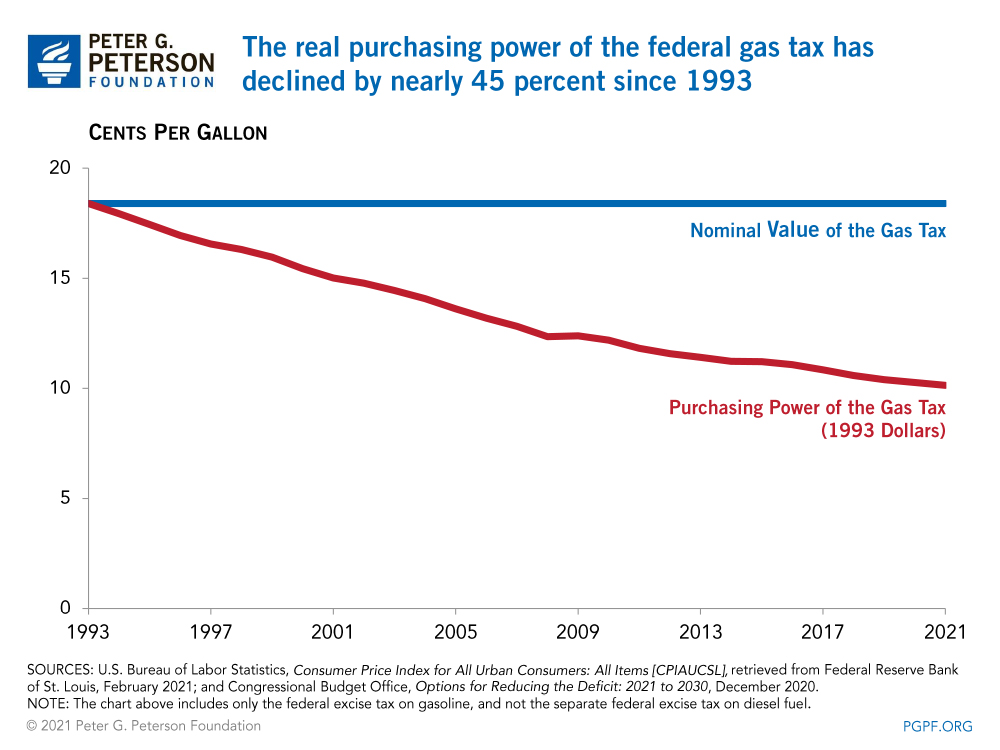

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

2022 Mileage Reimbursement Memo Effective July 1 2022

Irs Mileage Rate Explained Triplog

Opinion Repeal Connecticut S New Highway Use Tax

The Irs Increased The Mileage Rate For The Rest Of 2022 Ketel Thorstenson Llp

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

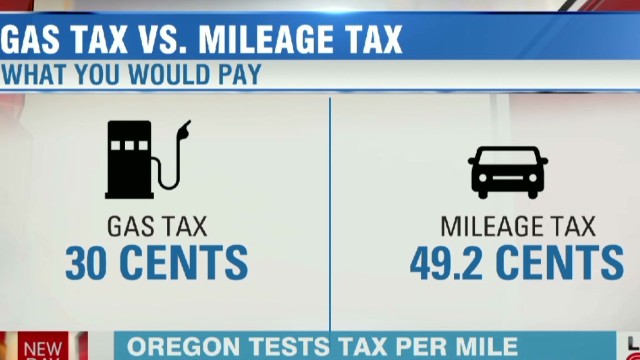

Could You Be Taxed Per Mile Cnn Video

2022 Payroll Tax Auto Mileage Rate Changes Wright Ford Young Co

2020 Mileage Rate Update Rate For Business Miles Decreases

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos